- Macro Point Daily

- Posts

- 06.10.25: Coinbase IPO, Bitcoin Eyes $110K Surge 🚀 & UK FCA Greenlights Retail Crypto ETNs

06.10.25: Coinbase IPO, Bitcoin Eyes $110K Surge 🚀 & UK FCA Greenlights Retail Crypto ETNs

Plus a $1B meme airdrop coming soon on Solana 👇

👋 Welcome Back to Macro Point Daily, The smartest crypto take of the day — macro trends, market moves, daily charts, and a side of memes.

Every day we provide the 5 stories which matter most in crypto, and one just for the degens.

In Today’s Edition

🏦 Coinbase files confidential IPO as listings return

📊 Crypto fund assets hit record $167B in May

🪙 UK proposes allowing retail crypto ETNs

🧱 Plume L2 mainnet launches with $150M TVL

🔁 XRP surges 10%, forms double-bottom pattern

🐸 Pump.fun plans $1B meme airdrop on Solana

Let’s dive in.👇

Today’s Edition

📌 Coinbase stalking IPO stage with confidential filing

Gemini filed quietly, and now Coinbase joins the fray—U.S. listings are back on track

Over the weekend, Gemini joined Coinbase in submitting a draft S‑1 filing to the SEC confidentially. This signals institutional ambition: crypto exchanges stepping into public markets could reframe regulatory discourse and investor access. Coinbase’s rumored move follows its S&P‑500 addition this May, while Gemini’s joining the queue adds momentum. Expect official filings mid-year—if markets hold, these listings could usher new capital into crypto and boost legitimacy.

🚀 Institutional pathways to crypto are strengthening

🏛️ Regulatory signals could prompt clarity around exchange oversight

💵 Public markets might flow back into crypto infrastructure

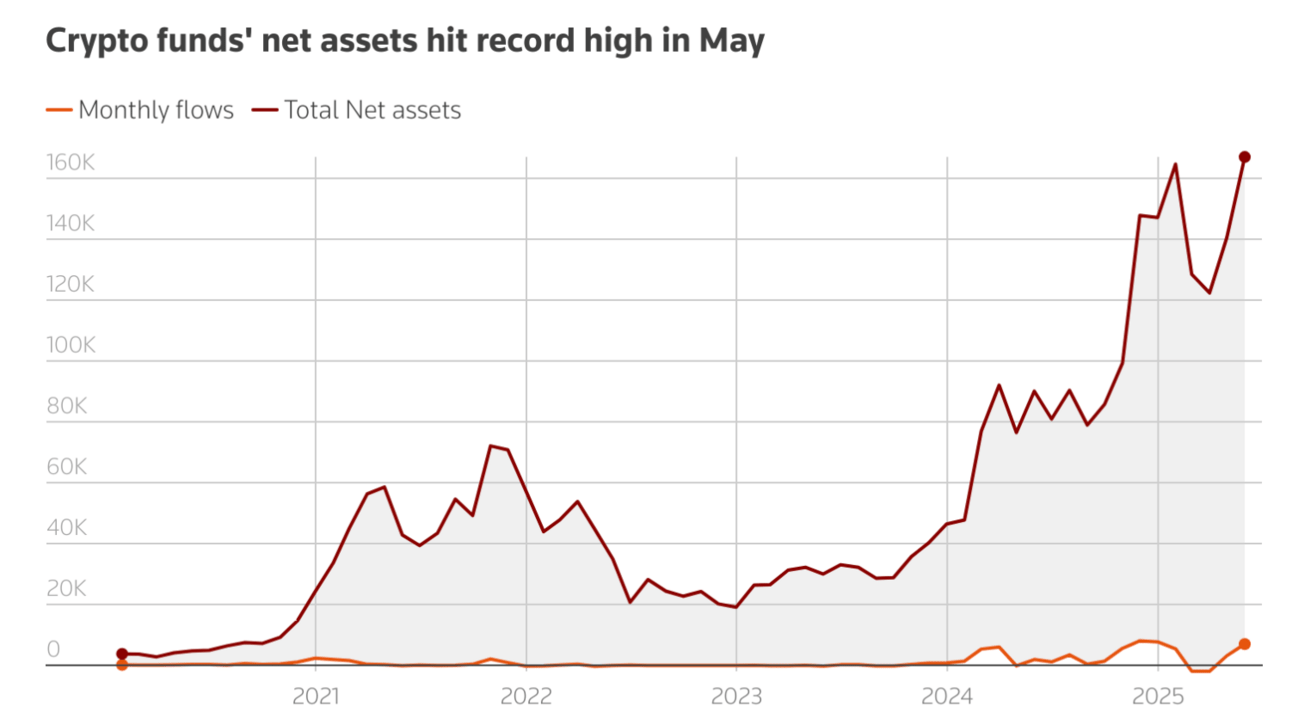

📉 Crypto fund assets hit record $167 B in May - Bitcoin Climbs Above $110K

Institutions pour in money as crypto matures into a portfolio pillar

Crypto funds recorded their highest-ever assets under management—$167 billion—thanks to $7.05 billion inflows in May. This weekend, investors treated crypto like both hedge and opportunity amid global volatility and trade peace signals. Bitcoin saw ~15% gains over the quarter, outpacing equity and gold returns. Institutional inflows—especially into spot-BTC and ETH products—help cement crypto’s evolving role as a core portfolio component. BTC climbed to over $110,000 on Monday, primarily driven by these institutional inflows.

🔼 Rising institutional interest in digital assets

⚖️ Crypto now seen as both a risk and a hedge

📍 Decoupling from traditional equity flows indicates structural demand

📊 XRP jumps ~10% over weekend, forming bullish double-bottom

One of the best-looking technical setups in altcoins right now

XRP surged almost 10% over the weekend, breaking notable resistance around $2.10. Technical setups show a textbook double-bottom pattern around that price, supported by bullish flags and Heikin-Ashi strength. A confirmed close above $2.30 on a 3-day candle—and maintaining above the 21-day EMA—could validate a run toward $3 or beyond. Volume and momentum this weekend suggest short-term upside if traders hold.

💥 Weekend price action confirms bullish reversal setup

📉 Key support at $2.07–$2.10 held steady

🎯 Clear target: $2.30 initial, then testing $3 resistance

📈 Plume L2 mainnet goes live with $150 M+ on-chain

Real-world asset tokenization is having a moment

Plume launched its Ethereum Layer‑2 mainnet this weekend, onboarding over $150 million in assets on day one—a strong debut for its real-world assets focus. Built for tokenizing solar farms, Medicaid claims, and mineral rights, Plume’s infrastructure passed rigorous testnet stress before launch. Its on-chain traction suggests compliance-ready enterprise appeal, possibly starting a wave of RWA-centric L2s. If they scale, Plume could carve a niche beyond finance-focused rollups.

🪙 Institutional-class TVL bolsters credibility

🔄 Real-world token use-case differentiator

🏗️ Success here may spark a new sector in L2 adoption

🛠 UK regulators open public comment on retail ETNs

Major access shift for crypto-linked investment products in the UK

This weekend, the FCA launched consultation on allowing crypto exchange-traded notes (ETNs) for retail investors. The shift from wholesale-only to retail-ready ETNs brings broader market access—with guardrails to hedge exposure. Though consultation runs until July 7, moves this week may indicate timing for rollouts. If greenlit, it promises regulated on‑ramps with transparency and structure, a significant shift in UK crypto policy.

🏦 Retail ETNs create new crypto channels under regulation

⚠️ Risk disclosures and limits will shape the product

🗓️ Public consultation signals likely H2 rollout

Degen Domain

🐸 Pump.fun teases $1 B token sale, with 10% airdrop rumor

Solana’s meme machine is about to go full tilt again

Pump.fun, the Solana-based meme-launch factory, brewed weekend hype: a $1 billion token sale at $4 billion valuation is rumored, plus a 10% community airdrop. Despite no official confirmation, chatter—via Blockworks, Cointelegraph, and others—caused SOL perps to spike ~12%. This could reinvigorate the Solana memecoin ecosystem on its own. But as Reddit users snarked: “time to stop pretending this is all just ‘harmless fun.” So proceed with meme-level caution.

🚀 Rumor-fueled volatility ready for splash

🎁 Airdrop potential = free token, high access

🛑 Risk capital only—this is fast-moving meme land

💬 Quote of the Day

“Crypto isn’t a sprint—it’s a relay.”

— Macro Point Ventures

See you tomorrow. Forward to a friend who still thinks ETFs are boring.

📉📈🧠🫡

— Macro Point Daily