- Macro Point Daily

- Posts

- Bitcoin Breaks $122K, ETH Clears $3K

Bitcoin Breaks $122K, ETH Clears $3K

Plus: Little Pepe's presale frenzy sparks memecoin mania 👇

👋 Welcome Back to Macro Point Daily, The smartest crypto take of the day — macro trends, market moves, daily charts, and a side of memes.

Every day we provide the 5 stories which matter most in crypto, and one just for the degens.

In Today’s Edition

🚀 BTC smashes fresh ATH at $122,273

📊 ETH finally breaks $3,000 barrier after months

🏛️ House "Crypto Week" kicks off with major bills

💰 XRP surges 5.3% toward $3 milestone

🛠️ Tokenization trend drives institutional adoption

🐸 Little Pepe presale targets DOGE throne

Let’s dive in.👇

Today’s Edition

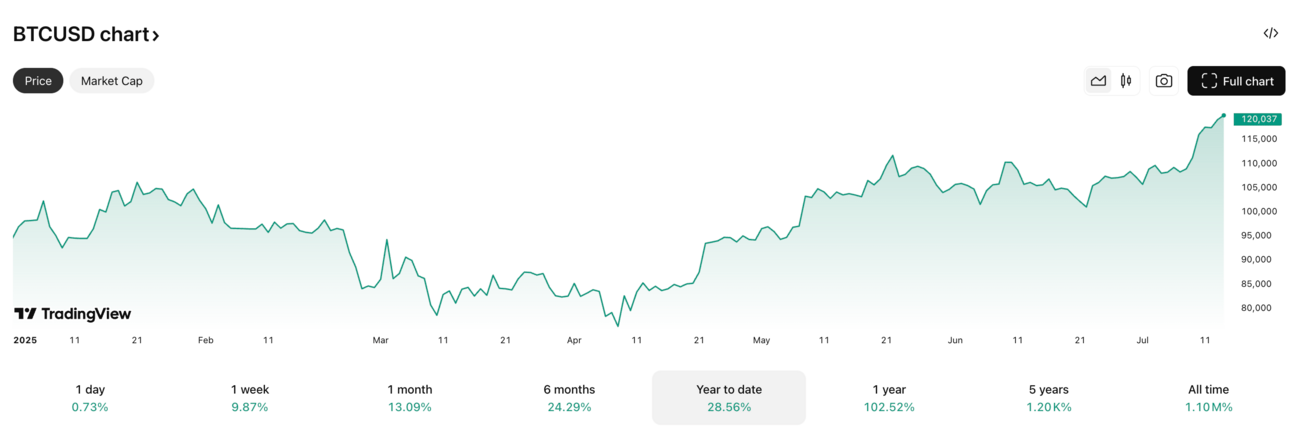

📌 Bitcoin Smashes Fresh ATH at $122,273

Market euphoria drives BTC to new heights amid institutional surge

Bitcoin exploded to a fresh all-time high of $122,273 today, jumping 3.7% in 24 hours as bullish momentum accelerates. The move came after briefly touching $121,000 earlier in the session, with institutional demand and short liquidations fueling the rally. Over $1 billion in shorts were wiped out last week, creating a powerful squeeze that propelled prices higher. Market sentiment remains bullish as Bitcoin consolidates above $122,000, with analysts eyeing $125,000 as the next major resistance level.

📈 Fresh ATH signals continued institutional adoption

🔥 $1B+ in short liquidations fuel momentum

⚡ Next resistance target sits at $125,000

📉 House "Crypto Week" Drives Regulatory Optimism

Congressional focus on digital assets boosts market confidence

The House of Representatives declared this week "Crypto Week," with plans to consider the CLARITY Act, Anti-CBDC Surveillance State Act, and Senate's GENIUS Act. House Financial Services Chairman French Hill and Agriculture Chairman GT Thompson announced the legislative push as part of efforts to make America the "crypto capital of the world." The regulatory clarity has contributed to today's bullish sentiment, with traders positioning for favorable outcomes. This marks a significant shift in Washington's approach to digital assets, providing much-needed policy framework for the industry.

🏛️ Three major crypto bills advance this week

🇺🇸 Bipartisan push for American crypto dominance

📈 Regulatory clarity drives institutional confidence

📉 ETH Breaks $3,000 Ceiling

Ethereum finally clears psychological resistance after months of struggle

Ethereum broke above $3,000 for the first time in 2025, rising 2.4% to $3,028 as institutional flows accelerate. The move ends months of consolidation below the key psychological level, with whale accumulation and ETF inflows providing support. Trading volume surged as the breakout confirmed, with analysts targeting $3,400 as the next major resistance level. The breakout above $3,000 represents a 20% gain from recent lows and signals renewed strength in the altcoin market.

🎯 First $3K break in 2025 confirms bullish trend

🐳 Whale accumulation supports higher prices

📈 Next target: $3,400 resistance level

📈 Tokenization Trend Drives Institutional Adoption

Real-world asset tokenization emerges as 2025's hottest narrative

Tokenization of real-world assets is gaining massive traction as institutions seek blockchain-based solutions for traditional finance. Stocks tied to Ethereum gained today on renewed enthusiasm for stablecoins and tokenization applications. The trend represents a fundamental shift toward bringing traditional assets on-chain, with everything from real estate to bonds being tokenized. Major financial institutions are exploring blockchain rails for settlement and custody, creating sustainable demand for Ethereum and Layer 2 solutions.

🏢 Institutions tokenize traditional assets on-chain

💼 Stablecoins and RWA drive sustainable demand

🔗 Blockchain rails replace legacy settlement systems

🛠 XRP Momentum Builds Toward $3

Cross-border payment solution gains institutional traction

XRP surged 5.3% today to $2.94, nearly touching the $3 milestone as institutional adoption accelerates. The move reflects growing confidence in Ripple's cross-border payment solutions, with banks and financial institutions increasingly adopting XRP for international transfers. Technical indicators suggest a breakout above $3 could trigger a move toward $3.50, with strong support building around current levels. The rally comes as regulatory clarity improves and real-world utility drives organic demand.

🌐 Cross-border payments drive organic demand

📊 Technical breakout targets $3.50 resistance

🏦 Banks adopt XRP for international transfers

Degen Domain

🐸 For the Degens: Little Pepe Presale Targets DOGE Throne

Layer 2 meme coin raises millions with infrastructure-first approach

Little Pepe (LILPEPE) is generating serious buzz with its fast-selling presale and ambitious plans to challenge Dogecoin's dominance. Unlike traditional meme coins, LILPEPE is built on a Layer 2 blockchain with real economic utility, targeting sustainable growth over hype cycles. The project has raised significant funds in its presale phase, with analysts projecting it could surpass DOGE in market cap by end of 2025. Early adopters are positioning for potential 100x gains as the project combines memecoin excitement with actual infrastructure development.

⚡ Layer 2 blockchain provides real utility

💰 Fast-selling presale raises millions

🎯 Analysts target DOGE market cap by year-end

💬 Quote of the Day

"We need to accumulate as much bitcoin as we can... to reach escape velocity."

— Simon Gerovich, CEO of Metaplanet

See you tomorrow. Forward to a friend who still thinks ETFs are boring.

📉📈🧠🫡

— Macro Point Daily