- Macro Point Daily

- Posts

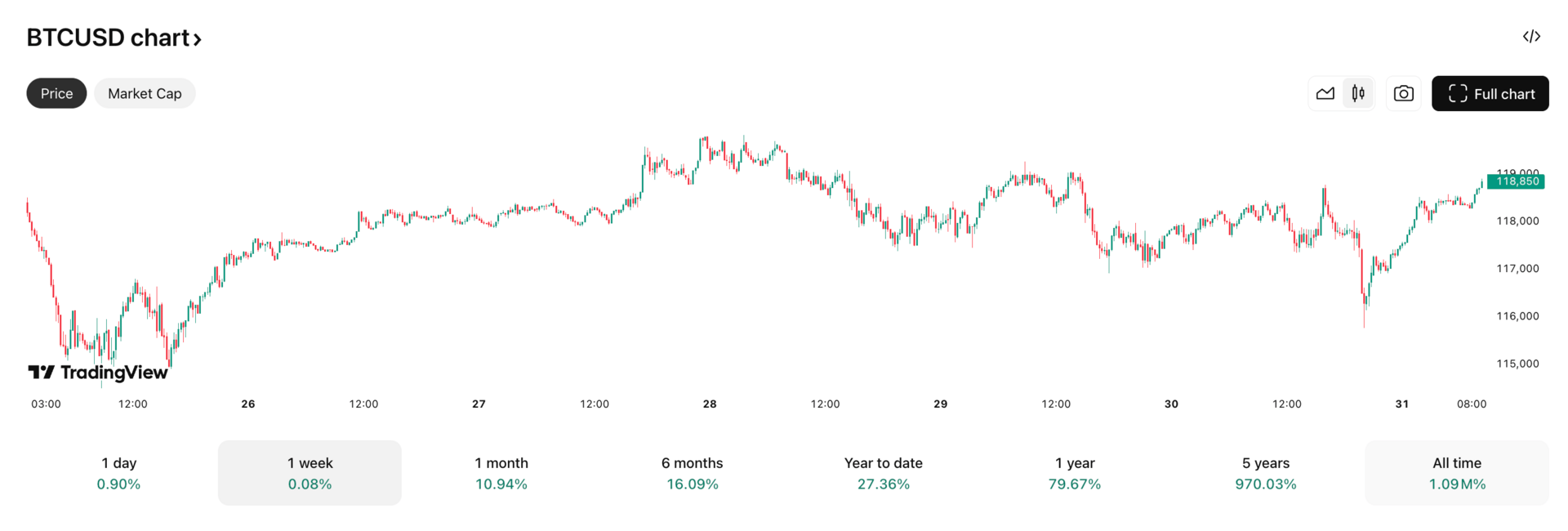

- Bitcoin Holds the Line at $118K

Bitcoin Holds the Line at $118K

Plus: the Fed decision that left crypto traders scratching their heads 👇

👋 Welcome Back to Macro Point Daily, The smartest crypto take of the day — macro trends, market moves, daily charts, and a side of memes.

Every day we provide the 5 stories which matter most in crypto, and one just for the degens.

In Today’s Edition

📊 BTC stays resilient above $118K despite market drop

🏦 Fed keeps rates steady, crypto dips 3.8%

📈 ETH holds $3,800 amid tariff uncertainty

💰 Institutional flows keeping markets afloat

🚀 L2 scaling solutions gaining traction

🐸 Meme coin madness continues unabated

Let’s dive in.👇

Today’s Edition

📌 Fed Holds, Crypto Holds Its Breath

The Federal Reserve kept interest rates unchanged yesterday, but crypto markets weren't exactly throwing a party.

The crypto market cap dropped 3.8% as investors digested the Fed's decision to maintain current rates while bracing for macroeconomic headwinds, with Bitcoin managing to hold above the key $118,000 support level despite earlier weakness. The decision comes as traders face uncertainty about future rate cuts and looming U.S. tariffs set to kick in tomorrow. Bitcoin's resilience at current levels suggests institutional support remains strong, but the broader market's 3.8% decline signals caution among retail investors. Next week's inflation data will be crucial for determining whether this consolidation continues or breaks either direction.

📉 Total crypto market cap falls 3.8% post-Fed decision

💪 Bitcoin maintains $118K support despite selling pressure

⏰ August 1st tariffs adding extra market uncertainty

📈 Tariff Tensions Take Center Stage

U.S. tariffs kicking in tomorrow are creating an additional layer of complexity for crypto markets already dealing with Fed uncertainty.

Ethereum remained resilient, hovering above $3,800 amid broader uncertainty fueled by looming U.S. tariffs set to kick in on August 1. These trade tensions are forcing investors to reconsider risk-on assets like crypto, particularly as global economic growth concerns mount. The timing couldn't be worse, with the Fed maintaining a hawkish stance and corporate earnings showing mixed results. Crypto's correlation with traditional risk assets means these tariffs could trigger more volatility in the coming days, especially if they impact tech companies with crypto exposure.

🌍 Global trade tensions escalating with new tariffs

📊 Risk-on assets facing increased scrutiny

💼 Corporate earnings adding to market complexity

📉 Bitcoin's $118K Support Test

Today's chart shows Bitcoin defending the critical $118,000 level despite broad market weakness.

The price action reveals a clear battle between bulls defending this psychological support and bears trying to break below. Volume patterns suggest institutional buying is supporting the floor, while retail sentiment remains cautious. The narrow trading range between $116K-$119K over the past week indicates consolidation before the next major move. Technical indicators show oversold conditions on shorter timeframes, but longer-term momentum remains neutral. A break below $116K could trigger accelerated selling toward $110K, while a move above $120K might signal renewed bullish momentum.

💪 $118K acting as strong psychological support

📈 Institutional buying evident in volume patterns

⚖️ Bulls and bears in equilibrium at current levels

📈 Layer 2 Summer Heating Up

Ethereum Layer 2 solutions are experiencing unprecedented growth as users seek cheaper transaction alternatives.

Daily active users across major L2s have increased 40% month-over-month, with transaction costs dropping to mere pennies compared to mainnet fees. This scaling breakthrough is attracting both DeFi protocols and NFT projects to migrate or expand their operations. The trend coincides with Ethereum's price stability above $3,800, suggesting the network's scaling roadmap is gaining real traction. Major institutional players are taking notice, with several announcing L2-specific investment funds this week.

🚀 L2 daily active users up 40% month-over-month

💰 Transaction costs dropping to penny levels

🏗️ Major protocols announcing L2 migrations

🛠️ Cross-Chain Infrastructure Gets Real

A new cross-chain messaging protocol launched today, promising to solve the fragmentation problem plaguing multi-chain DeFi.

The protocol enables seamless asset transfers and smart contract interactions across 15+ blockchains without relying on centralized bridges. Early testing shows transaction finality times of under 30 seconds and fees below $0.50 for most operations. The team behind the project includes former engineers from major blockchain companies and has backing from tier-1 VCs. This represents a significant step toward the interoperable future that crypto has been promising for years.

🌉 Supports 15+ blockchains without centralized bridges

⚡ Sub-30 second finality times achieved in testing

💎 Tier-1 VC backing with experienced team

Degen Domain

🐸 PEPE Variant Goes Parabolic

A new Pepe-themed meme coin called "PEPEFED" launched today and immediately pumped 2,400% before giving back half those gains.

The token, which features Federal Reserve Chairman Powell's face on a Pepe body, capitalized on today's Fed decision with perfect timing. Market cap peaked at $15 million before settling around $8 million as profit-taking kicked in. The coin's Telegram group gained 50,000 members in six hours, and early holders are sharing screenshots of 100x+ gains. It's peak degen season when monetary policy becomes meme material.

🚀 Peak gain of 2,400% within hours of launch

💰 Market cap hit $15M before settling at $8M

📱 50K Telegram members in six hours

💬 Quote of the Day

"In the short run, the market is a voting machine but in the long run, it is a weighing machine."

— Benjamin Graham

See you tomorrow. Forward to a friend who still thinks ETFs are boring. Not financial advice/ do your own research. Adios.

📉📈🧠🫡

— Macro Point Daily