- Macro Point Daily

- Posts

- 🔥 Bitcoin Nears All-Time High, DXY Steadies—but Degens Still Party

🔥 Bitcoin Nears All-Time High, DXY Steadies—but Degens Still Party

📊 Bitcoin pushing record highs as Macro factors like tariffs & Fed aim crypto, and Solana memecoins go bananas 👇

👋 Welcome Back to Macro Point Daily, The smartest crypto take of the day — macro trends, market moves, daily charts, and a side of memes.

Every day we provide the 5 stories which matter most in crypto, and one just for the degens.

In Today’s Edition

📈 Bitcoin inches near May record—stocks slump

💵 U.S. M2 money supply hits record $21.94T

🟣 Sui (SUI) eyes $100B market cap

🧱 LetsBONK dethrones Pump.fun on Solana

🗳️ GENIUS Act stablecoin bill heads to House

🐸 BONK token surge sparks 70%+ buzz

Let’s dive in.👇

Today’s Edition

🧨 ETF Inflows, Trump Tariffs, and a BTC Breakout Setup

Bitcoin inches up 0.8%, closing in on its $112K May high.

Markets are jittery ahead of Trump’s expected tariff announcement on July 9, while institutional capital keeps flowing into crypto ETFs. That combo is pushing Bitcoin higher, even as equities cool off. With the Fed signaling potential rate cuts this fall, BTC is building serious momentum. If Trump’s trade policy triggers a flight to alternatives, crypto could lead the charge.

📌 Bitcoin rose 0.8% to ~$108,944

🏦 Institutional ETF flows gaining momentum

🌐 Trump tariff threat adds risk-on pressure

🏦 Money Printer Still Buzzing: M2 Hits New High

U.S. M2 just hit a new record—$21.94 trillion.

That’s a staggering rise in the money supply, up nearly 4.5% year over year. For crypto, that’s rocket fuel—more dollars chasing risk assets. But it also raises inflation alarms, which could corner the Fed into more hawkish stances despite recession chatter. Traders are watching July inflation data and the Fed’s next steps like hawks.

💹 M2 growth at nearly 4.5%, highest in 3 years

⚖️ Inflation risk could push Fed to tighten

🚀 Loose money = crypto upside, but with turbulence

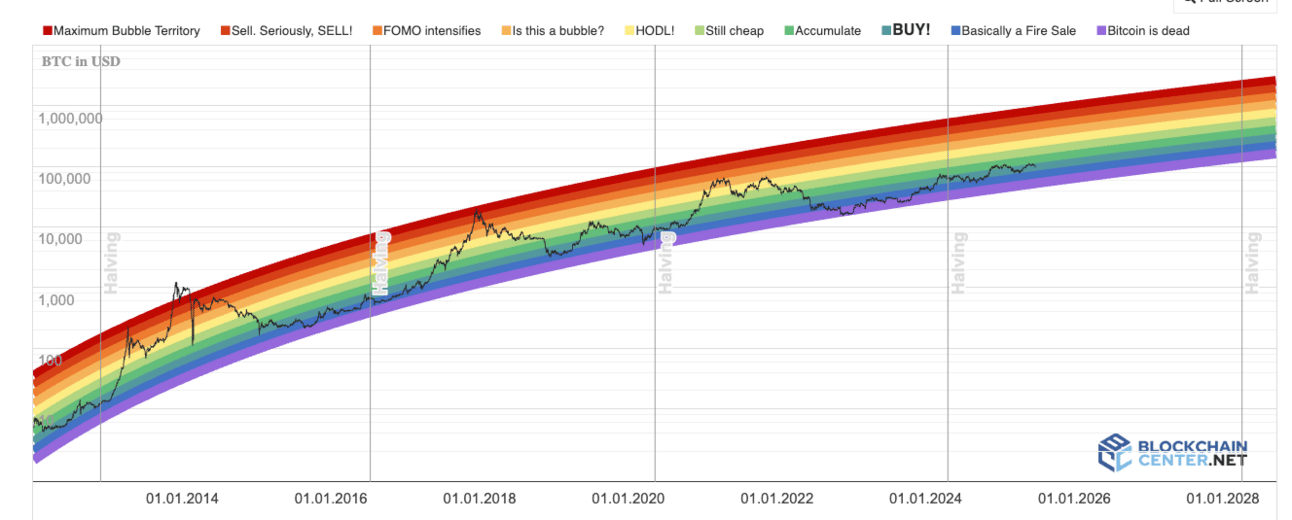

📉 Bitcoin Consolidation in the “Accumulate” Zone

BTC remains in mid-cycle mode, but pressure is building.

This rainbow chart shows Bitcoin trading in the blue “accumulate” band as it flirts with all-time highs. Historically, this zone precedes breakout moves—especially when macro winds align. Keep an eye on ETF inflows and rate cuts; they could be the final spark.

🔵 BTC still below red “bubble” band

🧭 Market sentiment turning risk-on again

📆 July macro events could drive breakout

🟣 SUI Eyes $100B Valuation—Is It for Real?

Sui Network has rallied ~18.5% in two weeks.

Analysts say if SUI breaks resistance at $3.08, it could run to $3.60 and set up a narrative for a $100B market cap. With Solana showing fatigue and Ethereum stuck, traders are looking for the next L1 pop—and SUI has the buzz, volume, and roadmap momentum to fit the bill.

📈 +18.5% performance in 14 days

🔓 Key resistance at $3.08 to $3.60

🎯 $100B market cap target enters trader chat

🏛️ GENIUS Act Passes Senate—Stablecoins on Deck

The bipartisan stablecoin bill heads to the House next week.

The GENIUS Act would mandate strict auditing and licensing requirements for fiat-backed stablecoin issuers. It’s a big step toward regulatory clarity—and could unlock more institutional adoption. If it passes the House during next week’s “Crypto Week,” expect stablecoin sentiment (and usage) to jump.

✅ Senate passed bill 68–30

🧾 Would require monthly audits and 1:1 reserves

🗳️ House vote expected July 14

Degen Domain

🐸 Let’s BONK Just Flipped Pump.fun

Solana’s LetsBONK memecoin launcher is raking in $1M/day.

It just overtook Pump.fun in daily revenue and helped the BONK token jump 52% in 48 hours. With 18,000+ meme tokens launched in a single day and Solana inflows building, degens are back in full force. Some traders are betting BONK sees a 70% pump if momentum keeps rolling.

💰 ~$1M revenue in 24 hours

📈 BONK token +52% this week

🚀 SOL accumulation hints at 70% upside

💬 Quote of the Day

“Loose money is rocket fuel. Regulation decides the landing.”

— Lyn Alden

See you tomorrow. Forward to a friend who still thinks ETFs are boring.

📉📈🧠🫡

— Macro Point Daily