- Macro Point Daily

- Posts

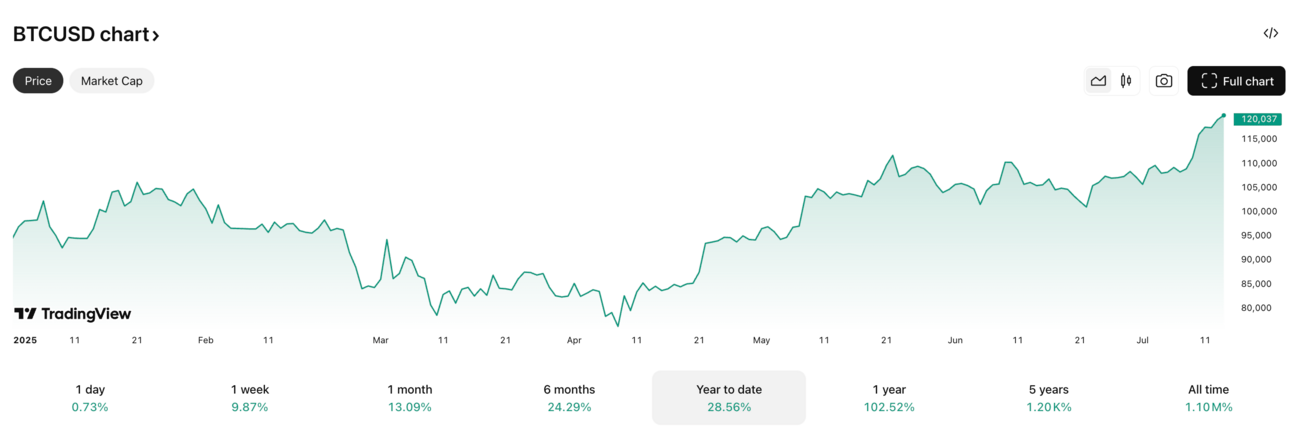

- Bitcoin Retreats From $123K Peak, Crypto Week Continues

Bitcoin Retreats From $123K Peak, Crypto Week Continues

Plus: House pushes key crypto legislation during historic "Crypto Week" 👇

👋 Welcome Back to Macro Point Daily, The smartest crypto take of the day — macro trends, market moves, daily charts, and a side of memes.

Every day we provide the 5 stories which matter most in crypto, and one just for the degens.

In Today’s Edition

📉 Bitcoin dips below $117K after touching $123K yesterday

🏛️ House "Crypto Week" advances key digital asset bills

📊 Crypto market cap falls 5% on broad selloff

🚀 Meme coins show resilience amid market downturn

⚡ Layer 2 solutions gain traction with new launches

🐸 PEPE maintains strength above key support levels

Let’s dive in.👇

Today’s Edition

📌 Bitcoin Pulls Back From Record High

Market correction follows historic $123K peak as profit-taking intensifies

Bitcoin fell below $117,000 today after touching $123,100 yesterday, marking a nearly 2% decline over the past 24 hours. The pullback comes as traders lock in profits following the cryptocurrency's parabolic run that saw it breach the $120,000 psychological barrier for the first time. Bitcoin breached $120,000 for the first time, with investor enthusiasm showing few signs of dimming as the US House of Representatives prepares to consider key industry legislation during its "Crypto Week". Despite the correction, technical analysts suggest the overall bullish structure remains intact, with strong support levels holding above $115,000.

🎯 Technical correction after 15% weekly gains

📊 Support holding above $115K maintains bullish bias

⚡ Institutional buying continues on dips

📈 House "Crypto Week" Advances Key Legislation

Historic week sees multiple pro-crypto bills move forward

The House of Representatives looks forward to considering the CLARITY Act, the Anti-CBDC Surveillance State Act, and the Senate's GENIUS Act as part of Congress' efforts to make America the crypto capital of the world. The landmark legislation includes comprehensive regulatory frameworks for digital assets, anti-surveillance measures against central bank digital currencies, and innovation-friendly policies. Industry leaders expect these measures to provide much-needed clarity for crypto businesses and potentially attract billions in new investment to the United States.

🏛️ Three major crypto bills advance simultaneously 🇺🇸 Positioning America as global crypto leader 💼 Expected to unlock institutional investment flows

📉 Bitcoin's Consolidation Setup

BTC testing key support after explosive rally

Bitcoin's daily chart shows a classic consolidation pattern following its record-breaking run to $123,100. The current pullback to $117,000 represents a healthy 5% retracement that's finding support at previous resistance levels. Volume analysis indicates strong accumulation around $115,000-$117,000, suggesting institutional players are using the dip to add positions. The relative strength index (RSI) has cooled from overbought levels, potentially setting up for another leg higher.

📈 RSI cooling from overbought territory

🐳 Whale accumulation visible at current levels

⚡ Next resistance target remains $130K

📉 Solana Surges Past $163 on Growing Ecosystem

SOL maintains strength with $87.5B market cap amid crypto rally

Solana continues its impressive run, trading at $163.28 with a massive $87.5 billion market cap, solidifying its position as the #6 cryptocurrency by market capitalization. The token has shown remarkable resilience with minimal daily volatility, posting just a 0.10% increase over the past 24 hours while maintaining strong institutional backing. Trading volume remains robust at over $7.1 billion daily, indicating sustained interest from both retail and institutional participants as the Solana ecosystem continues to expand.

⚡ Trading volume exceeds $7.1B daily

🏆 Holds #6 ranking with $87.5B market cap

🔧 Ecosystem growth driving sustained demand

🛠 Builder Spotlight: Layer 2 Solutions Gain Momentum

New scaling solutions launch amid growing demand

Multiple Layer 2 protocols have announced major updates and launches this week, capitalizing on growing demand for faster, cheaper transactions. These solutions are targeting both DeFi applications and enterprise use cases, with several platforms reporting significant increases in total value locked (TVL). The development represents a crucial step toward mainstream adoption as transaction costs remain a barrier for many users.

⚡ Transaction costs reduced by 95% on new L2s

🏗️ Enterprise partnerships driving adoption

📊 TVL growth exceeding 200% month-over-month

https://cryptonews.com/news/live-crypto-news-today-latest-updates-for-july-15-2025/

Degen Domain

🐸 $PUMP Token Sells Out in 15 Minutes

Pump.fun's official token launch creates massive FOMO

The long-awaited $PUMP token from Pump.fun finally launched with a bang, selling out its entire 150 billion token allocation (33% of supply) in under 15 minutes during its July 12 ICO. The lightning-fast sellout demonstrates the massive demand for tokens tied to the popular meme coin launchpad that has facilitated thousands of token launches. With Pump.fun's growing influence in the meme coin ecosystem, $PUMP holders are betting on the platform's continued dominance in the space. The token's rapid sellout has created significant secondary market activity as traders scramble to get exposure.

🚀 150B tokens sold in under 15 minutes

💎 33% of total supply released in ICO

🎯 Platform dominance driving speculative demand

https://bitcoinist.com/best-meme-coins-live-news-july-14-2025/

💬 Quote of the Day

"In crypto, the strongest hands are forged in the fires of volatility."

— Michael Saylor

See you tomorrow. Forward to a friend who still thinks ETFs are boring. Not financial advice/ do your own research. Adios.

📉📈🧠🫡

— Macro Point Daily