- Macro Point Daily

- Posts

- Tariff Shock, Crypto Drops — What’s Next for the Bounce?

Tariff Shock, Crypto Drops — What’s Next for the Bounce?

👋 Welcome Back to Macro Point Daily, The smartest crypto take of the day — macro trends, market moves, daily charts, and a side of memes.

Every day we provide the 5 stories which matter most in crypto, and one just for the degens.

In Today’s Edition

📉 $19B wiped as market front-runs tariffs

💱 BTC sinks below $105K

🇪🇺 EU plots crypto consolidation under ESMA

🛠 Solana memecoin launchpad caught in crosshairs

📉 Whale shorts rake in $160M

🐸 $TRUMP keeps flipping narratives

Let’s dive in.👇

Today’s Edition

📌 U.S. Tariff Escalation Becomes Market’s Biggest Shockwave

Trump’s 100% tariff bomb ignited a $19B crypto wipeout.

The White House’s move to slap a full 100% tariff on Chinese tech exports (plus export controls on critical software) spurred a broad sell-off, pulling Bitcoin down ~8.4% to ~$104,782.

Markets treated the announcement not as bluster but as a real arms-length move. Panic and forced liquidations deepened the slide. Tomorrow, we’ll see if crypto can claw back—especially if China responds or escalates.

📌 Markets see this as new baseline, not one-off

⚖️ Recovery viability depends on macro tone

👀 China’s response could set the next leg

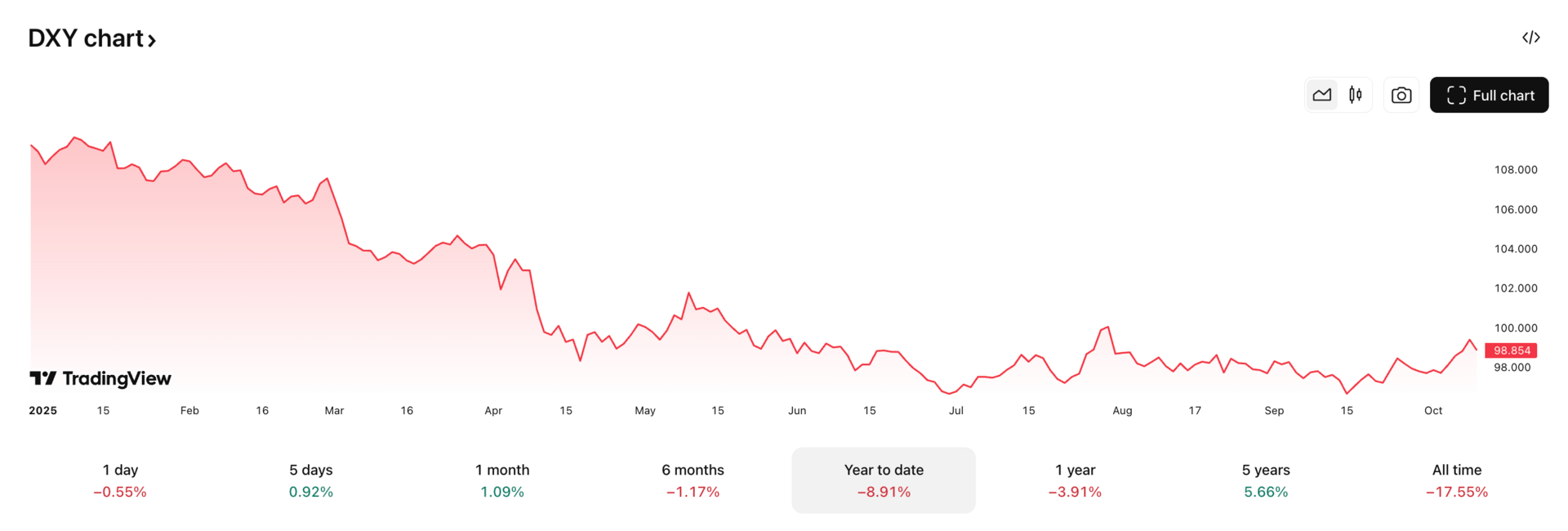

📈 Tariff Risk Ramps Up Rate Volatility

Geopolitics reinsert rate risk into crypto’s narrative.

The trade shock pushes inflation fears back into the spotlight, potentially reshaping chances for central banks. A resurgent dollar, aided by safe-haven flows, could lure capital out of crypto. Meanwhile, yield curves and bond volatility will tell whether this is a tactical derisk or durable shift.

💵 USD strength = headwind

📈 Rate volatility will scare growth bets

🔄 Fed rhetoric will be under heavy scrutiny

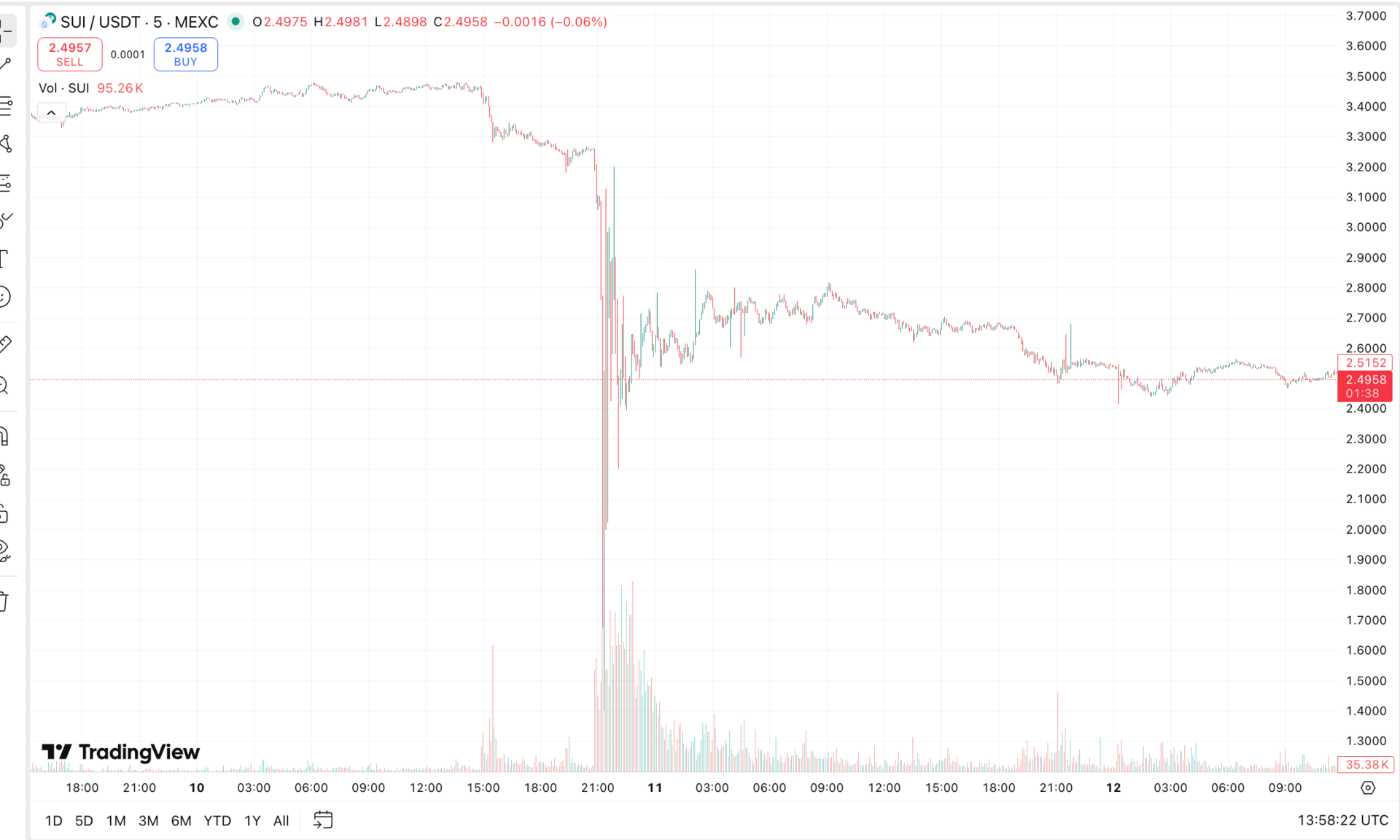

📉 SUI’s Friday Collapse: A Flash Crash Unpacked

SUI plunged nearly 87% in minutes

On October 10, SUI fell from ~$3.80 to ~$0.50 following a scheduled unlock of 44 million tokens (~$144M), which triggered a cascade of liquidations across exchanges. It later partially recovered to ~$2.40, but still ended ~20.75% lower, underperforming broader markets. With order books thin and volatility overheated, SUI now trades precariously—technicals warn that if $2.82 fails, it could test ~$2.11.

🔻 Extreme illiquidity magnified the crash

⚖️ Support levels are fragile; bounce needs strength

👀 Watch next unlocks, volume spikes, and macro cues

📈 EU Centralizes Crypto Oversight

ESMA Set for Bigger Role Under MiCA Strains

The European Securities and Markets Authority (ESMA) aims to absorb more supervisory power over crypto firms, exchanges, and clearing under MiCA’s framework—a shift away from national regulators. The move intends to reduce fragmentation and raise compliance bar for cross-border operators. For projects building in Europe, this ups the urgency on regulatory alignment.

🇪🇺 Central oversight becomes a structural narrative

🧩 National arbitrage shrinks

⚙️ Compliance burden likely jumps

www.ft.com/content/36bd279c-215e-4582-90ff-7efd6bfa54ea?utm_source=chatgpt.com

🛠️ Memecoin Factory Gets a Regulator’s Look

Pump.fun’s launch plans collide with compliance friction.

Pump.fun and cofounder channels were suspended briefly—an action seen as regulatory caution bleeding into execution. Behind the scenes, the team was planning a $1B token raise, but now they face structural scrutiny over incentives, tokenomics, and legal exposure. Their next steps—pause, pivot, or comply—will ripple through memecoin launch culture.

🚧 Tokenomics transparency will matter more

🗣 Social channel health equals protocol health

🔄 Incentive models may shift toward defensibility

Degen Domain

🐸 $TRUMP Survives the Carnage

Meme Coin Defies Gravity (for now)

In a sea of red, $TRUMP still draws breath.

Even as broader memecoin rout decimates speculative assets, $TRUMP hasn’t flatlined. Reports suggest 800M tokens are held by Trump-aligned entities. It’s narrative fuel more than protocol, but in volatile regimes such coins can pick up absurd momentum if sentiment whips.

🪙 Ultra speculative, ultra high risk

🎯 Moves driven by headlines, not fundamentals

🧨 Watch volume spikes and social breath

💬 Quote of the Day

“Markets climb walls of worry, then fall down slopes of greed.” — Paul Samuelson

See you tomorrow. Forward to a friend who still thinks ETFs are boring. Not financial advice/ do your own research. Adios.

📉📈🧠🫡

— Macro Point Daily